sales tax calculator tucson az

Did South Dakota v. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ.

Dmv Fees By State Usa Manual Car Registration Calculator

The current total local sales tax rate in tucson az is 8700.

. Tucson Sales Tax Rates for 2022 Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson. The Tucson sales tax rate is 26.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. There is no applicable special tax. The County sales tax rate is 0.

AZ Sales Tax Rate. 260 Public Utility Additional Communications 105. 3 beds 2 baths 1579 sq.

The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Once you have a budget in mind multiply that number times the decimal conversion of the sales tax percentage in your municipality.

Tax Paid Out of State. The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax Comparison Calculator for 202223. Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Tucson sales tax in 2021.

Most transactions of goods or services between businesses are not subject to sales tax. 260 Public Utility. This is an Arizona sales tax calculator designed to meet the specific needs of the construction industry.

Enter the Sales Price and have the system calculate the sales tax to be added to arive at the total gross amount or 2 Enter the total Gross Amount and have the system factor the sales. Choose the Sales Tax Rate from the drop-down list. The sales tax jurisdiction name is Arizona which may refer to a local government division.

For more information on vehicle use tax andor how to use the calculator click on the links below. Depending on local municipalities the total tax rate can be as high as. For tax rates in other cities see arizona sales taxes by city and county.

You can calculate Sales Tax manually using the formula or use the Tucson Sales Tax Calculator or compare Sales Tax between different locations within Arizona using the Arizona State Sales Tax Comparison Calculator. Az Sales Tax - Prime Contracting - Class 015. You can print a.

Arizona has a 56 statewide sales tax rate but also has 80 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2403 on top of the state tax. Sales tax is a tax paid to a governing body state or local for the sale of certain goods and services. Tucson is located within Pima County Arizona.

Within Tucson there are around 52 zip codes with the most populous zip code being 85705. Enter your Amount in the respected text field. The minimum combined 2022 sales tax rate for Tucson Arizona is.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Sales Tax Rate s c l sr. If this rate has been updated locally please contact us and we will update the sales tax rate for Tucson Arizona.

Multiply the price of your item or service by the tax rate. The arizona sales tax rate is 56. If youre looking for an Arizona car tax calculator you can find the figure yourself with some basic calculations.

The average sales tax rate in Arizona is 7695. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Arizona local counties cities and special taxation districts. This is the total of state county and city sales tax rates.

How to Calculate Sales Tax. How to use Tucson Sales Tax Calculator. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ.

Sales tax in Tucson Arizona is currently 86. Groceries are exempt from the Tucson and Arizona state sales taxes. The current total local sales tax rate in Tucson AZ is 8700.

Price of Accessories Additions Trade-In Value. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The December 2020 total local sales tax.

Then use this number in the multiplication process. This will give you the sales tax you should expect to pay. The Arizona sales tax rate is currently 56.

Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ. 4510 E Glenn St Tucson AZ 85712 324999 MLS 22212727 This beautiful 3 bedroom 2 bath home is surrounded by mature landscaping that offers plen.

Sales tax calculator of 85710 tucson for 2021. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax.

Method to calculate New Tucson sales tax in 2021. Find list price and tax percentage. This includes the rates on the state county city and special levels.

The average cumulative sales tax rate in Tucson Arizona is 801. The minimum combined 2022 sales tax rate for Tucson Arizona is 87. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112.

Wayfair Inc affect Arizona. Tucson AZ Sales Tax Rate.

How To Charge Sales Tax Vat With Samcart Samcart

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Arizona Sales Tax Small Business Guide Truic

Arizona Sales Tax Small Business Guide Truic

Arizona Sales Tax Rates By City County 2022

How To Calculate Sales Tax On Calculator Easy Way Youtube

How To Calculate Sales Tax Video Lesson Transcript Study Com

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Pin By Linnell King Edwards On Andy Braun Loan Officer Flyers Home Buying Finance Plan Paying Off Mortgage Faster

2021 Arizona Car Sales Tax Calculator Valley Chevy

How To Calculate Cannabis Taxes At Your Dispensary

Arizona Sales Tax Guide And Calculator 2022 Taxjar

How To Calculate Cannabis Taxes At Your Dispensary

Property Tax Calculator Casaplorer

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona

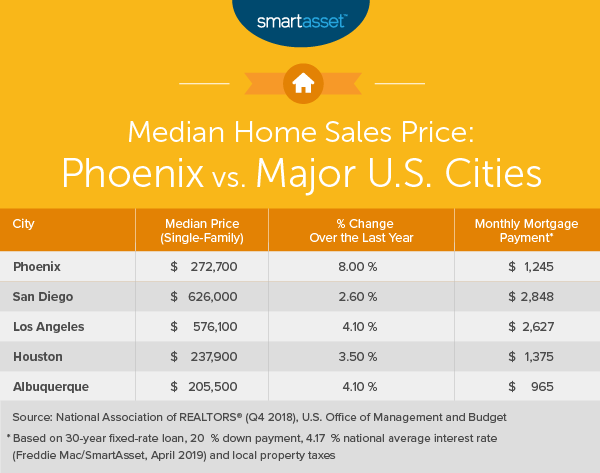

Cost Of Living In Phoenix Smartasset

Sales Tax Rates In Tucson And Pima County Pima County Public Library