do you have to pay inheritance tax in arkansas

Arkansas also has no inheritance tax. This does not mean however that Arkansas residents will never have to pay an inheritance tax.

Arkansas Inheritance Laws What You Should Know Smartasset

Unlike gift and estate taxes which are paid by the estate before the transfer of an asset an inheritance tax is paid by the recipient of the gift after the transfer.

. However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without a valid will. States such as Iowa New Jersey Kentucky and Pennsylvania collect inheritance tax. Do I pay inheritance tax on property.

An inheritance tax is a state levy that Americans pay when they inherit an asset from someone whos died. Generally your beneficiaries your beneficiaries who inherit your estate do not have to pay tax on your estates assets. Arkansas does not impose an inheritance tax.

If inheritance tax is paid within three months of the decedents death a 5 percent discount is allowed. The estate may also have to pay federal and state taxes before the inheritance is passed to you. In 2021 federal estate tax generally applies to assets over 117 million.

Arkansas does not have an inheritance tax. There is no federal inheritance tax but there is a federal estate tax. Arkansas inheritance and gift tax.

The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax. Arkansas Inheritance and Gift Tax. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individuals death.

Arkansas does not collect inheritance tax. If you inherit property you dont have to pay a capital gains tax until you sell the plot. According to the 2021 House Price Index the average property value in the UK is 256405 which could easily push an estate above the 325000 threshold when combined with other assets.

Arkansas does not have a state inheritance or estate tax. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. You can use the advance for anything you need and we take all the risk.

If your probate case does not pay then you owe us nothing. No inheritance tax is owed and theres no need to file an Inheritance and Estate Tax Return with the Louisiana Department of Revenue. However residents of Arkansas will have to pay inheritance tax if they inherit property from states that collect the tax.

The Pennsylvania inheritance tax for instance applies to out-of-state inheritors. However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without. Those who inherit homes in wills may have to pay taxes on rental income given to them.

The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of your assets than you. However residents of arkansas will have to pay inheritance tax if they inherit property from states that collect the tax. Instead of applying an inheritance tax after an estate tax heirs do not have to shoulder the financial burdens of.

Theres no inheritance tax at the federal level and how much you owe depends on your. Inheritance laws of other states may apply to you though if you inherit money or assets from someone who lives in a state that has an inheritance tax. You would pay 95000 10 in inheritance taxes.

The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax. Other inheritors such as children and domestic partners may be entitled to a different exemption status and tax rate depending on which state they live in. As you can imagine an inheritance tax can have a significant impact on the value of your inheritance if it applies.

You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000. Youll pay taxes on your inheritance when you receive income from the estate or directly from money generated by the assets. One of the highest value assets in someones estate is likely to be their property.

This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax. This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you. You would receive 950000.

However in some states the total estate of the deceased may be subject to an estate or inheritance tax. Arkansas does not have a state inheritance or estate tax. Do you have to pay inheritance tax in Arkansas.

There is no obligation. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Even though Arkansas does not collect an inheritance tax however you could end up paying inheritance tax to another state.

1 Some states only tax high-value estates while others charge a. The good news for people who inherit money or other property is that they usually dont have to pay income tax on it. Beneficiaries generally dont have to pay income tax on money or other property they inherit with the common exception of money withdrawn from an inherited retirement account IRA or 401k plan.

An heirs inheritance will be subject to a state inheritance tax only if two conditions are met. State rules usually include thresholds of valueinheritances that fall below these exemption amounts arent subject to the tax. In those states that do impose an inheritance tax spouses may inherit without the estate incurring an inheritance tax.

Your credit history does not matter and there are no hidden fees. In fact as discussed below the Louisiana Department of Revenue has stopped issuing receipts It is unclear whether people who died on or before June 30 2004 will be subject to inheritance tax if an inheritance tax return was filed before July 1. The estate would pay 50000 5 in estate taxes.

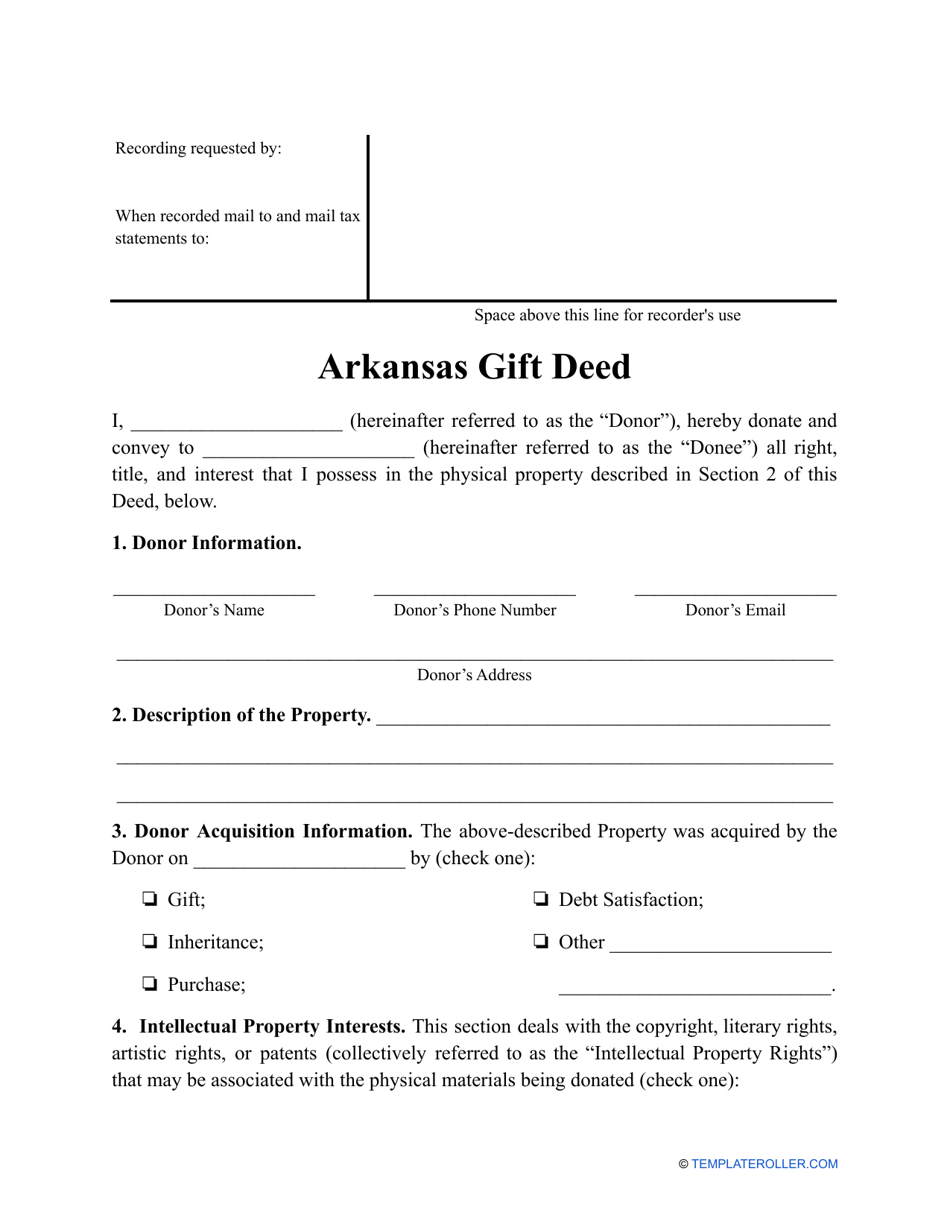

Arkansas Gift Deed Form Download Printable Pdf Templateroller

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Advance Legislative Service Lexisnexis Store

Understanding The Probate Process In Arkansas Bond Law Office

Arkansas Inheritance Laws What You Should Know Smartasset

Complete Guide To Probate In Arkansas

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Complete Guide To Probate In Arkansas

Arkansas Inheritance Laws What You Should Know Smartasset

Arkansas Retirement Tax Friendliness Smartasset

Arkansas State 2022 Taxes Forbes Advisor

Arkansas Estate Tax Everything You Need To Know Smartasset

Historical Arkansas Tax Policy Information Ballotpedia

Why Do You Need An Arkansas Elder Law Attorney William Zac White Attorney Counselor At Law

Arkansas Estate Tax Everything You Need To Know Smartasset

Where S My State Refund Track Your Refund In Every State

Arkansas Code Of 1987 Annotated Court Rules Lexisnexis Store

Is There An Inheritance Tax In Arkansas

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel